- AME CAPITALS

- Trading Technology

- Help AME Trading

Part VI. Random walk in the forex market

In the world of Forex, individuals can be divided into theorists, practitioners, and skeptics. Theorists study the processes taking place in the Forex market but prefer to stay away from the risk of opening trading positions. These individuals are essentially researchers, and the currency market is their subject of exploration. Practitioners, on the other hand, prefer active participation over passive observation. Risk is their way of life, and Forex trading is an opportunity to improve their financial situation. They strongly believe in the existence of the Holy Grail in Forex—a foolproof trading strategy capable of generating profits in a geometric progression. Lastly, skeptics refute the predictability of currency exchange rates' behavior, challenge the views underlying Dow Theory, and consider the Forex market as nothing more than a chaotic process.

So far, we have covered many theoretical foundations of Forex market analysis. In this section, we will take a skeptical look at the Forex market because a complete understanding of anything is impossible without considering alternative perspectives. So, what is the Forex market according to skeptics? In the theory of probability, familiar to us from university-level mathematics, there is a concept called a random walk of a particle. In simplified terms, a random walk looks as follows: at each specific time interval, starting from the origin, the particle moves to the right along the x-axis (OX), and with a 50/50 probability, it either moves up or down by one unit along the y-axis (OY).

At first glance, it may appear that a particle moving according to such an algorithm will constantly oscillate around the zero level on the y-axis. However, in reality, this is not the case. The particle will trace out a genuine graph of a random process, with its peaks and troughs, highs and lows. According to the theory, the probability of the particle returning to the zero level on the y-axis is 100% when considering an infinite amount of time. But such a statement does not provide any meaningful information because, over a finite number of time intervals, the particle may or may not return to the zero level.

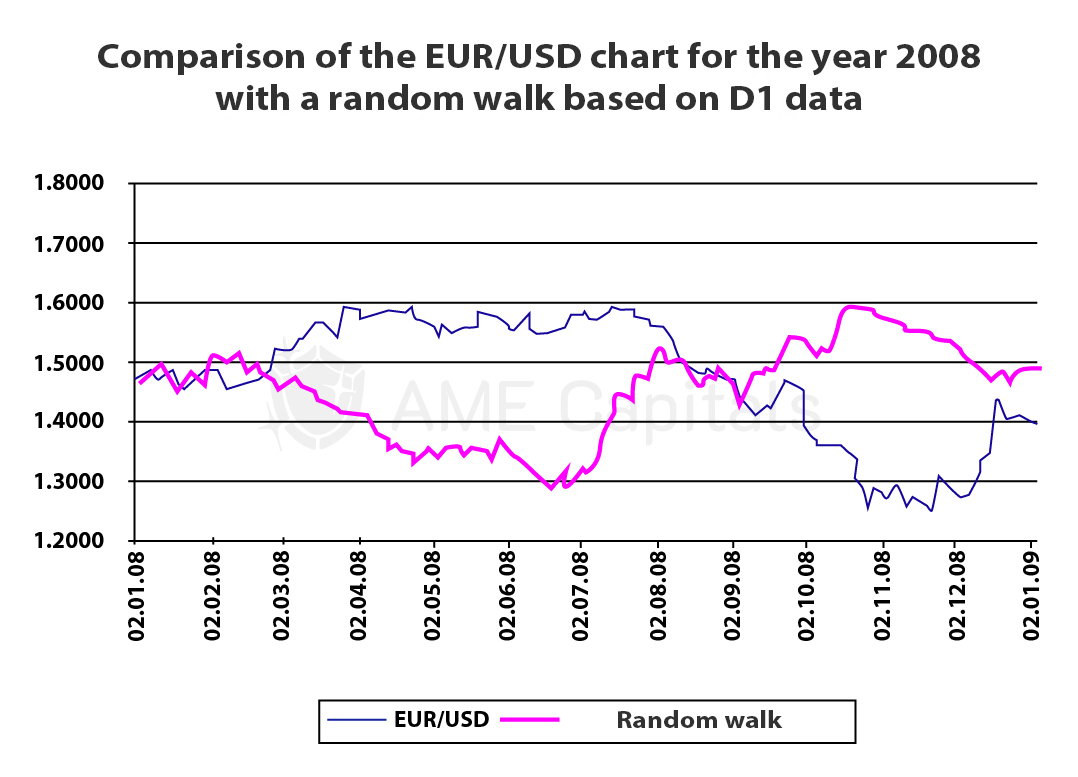

Your experiment involved modifying the standard random walk algorithm and analyzing the daily (D1) chart of the EUR/USD currency pair for the year 2008. You determined the average daily range of candle bodies (the absolute difference between the opening and closing prices) based on historical data, which resulted in 17 pips. You then set the starting point of your virtual graph to January 1, 2008 (the beginning of the daily chart of the currency pair). For each new day, the point on the virtual graph either moved up or down with a 50/50 probability. The step size was determined by multiplying a random value ranging from 0 to 1 by twice the average daily range of the candle bodies, which is 34. The virtual graph you obtained is depicted in the figure alongside the actual EUR/USD price chart.

Without referring to the legend of the chart, it is almost impossible to determine which one represents the actual Forex price chart and which one is the simulated one. It is interesting to note that on random walk charts, one can find support and resistance levels, continuation and reversal patterns, Elliott Waves, and many other elements of technical analysis in the Forex market. These charts also exhibit sudden drops and rapid rises, consolidation periods, and the formation of new trends.

In this chapter, we have provided you with food for thought. Is it really possible to accurately forecast currency price behavior with any degree of precision other than the infamous 50/50? Do prices truly exhibit repetitive patterns in their behavior? Can one truly become wealthy by trading currencies as a private investor in the Forex market? Unfortunately, there are no definitive answers to these questions. Statistics show that 95% of novice traders quickly lose their initial deposits. Whether the remaining 5% of traders find a mechanism for consistent earnings in Forex or are simply lucky individuals whose winning streak will eventually end remains a mystery. The secret lies in the fact that each new Forex trader must unravel this mystery for themselves.