- AME CAPITALS

- Trading Technology

- Help AME Trading

Part V: Sophisticated Trading Tactics

In Forex trading, the simplest approach is to open a single position with the intention of closing it with a profit or loss. However, in practice, this approach is mostly used by beginners. Professionals, on the other hand, employ more sophisticated tactics, which will be discussed in this concluding section of the Forex training.

Trading tactics in online trading are just as important as capital management rules. However, it is not recommended to use advanced trading tactics without sufficient trading experience in Forex. Approach this matter as you would approach learning to drive a car. Initially, you need to adapt to the controls, make your basic actions automatic, and only then can you drive while simultaneously smoking, listening to music, and talking on the phone.

Without automating your basic trading actions, you won't be able to effectively utilize sophisticated trading tactics. Therefore, before applying what you read in the following chapters, execute hundreds of simple trading operations on a demo or mini account. Once you feel confident as a user of the trading platform, you can experiment with the material presented in this section in practical trading.

Part V. Sophisticated Trading Tactics / Chapter 1. Trend Trading

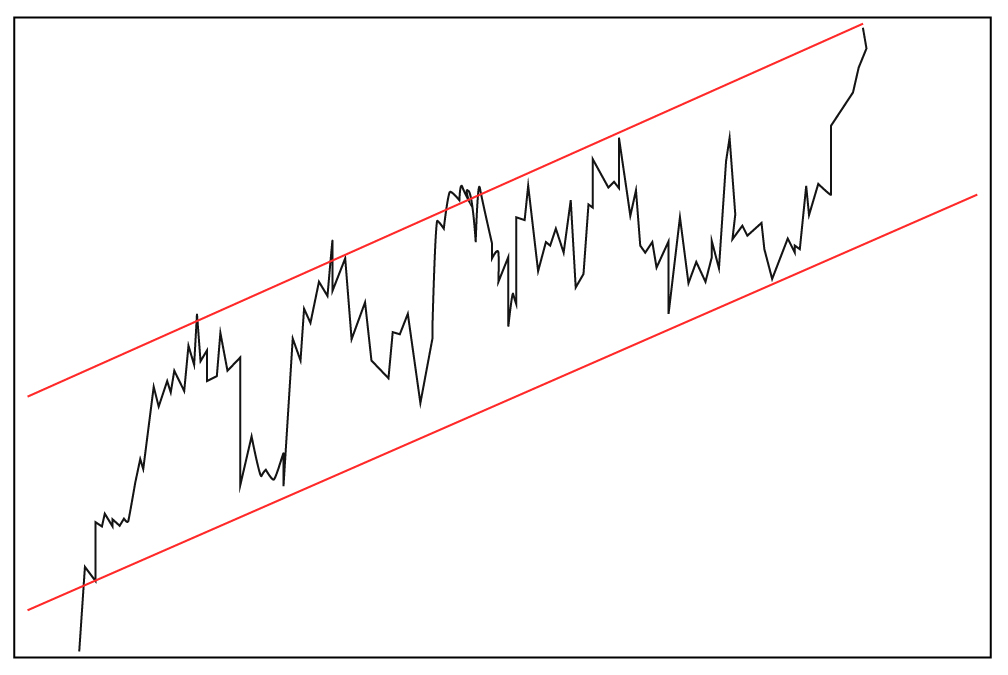

One of the simplest tactics we will discuss is trading along the trend. The key aspect of this tactic is identifying the trend, its support (resistance) levels, and the trading range. The chart below displays the daily quotes of the EUR/USD currency pair. The red lines on the chart represent the ascending trend channel formed by the resistance line and a parallel line drawn through the local minimum.

In the tactic of trading along an ascending trend, it is necessary to buy at the lower line of the channel and sell at the upper line. In a descending trend, it is the opposite. It is worth noting that applying such an approach when trading against the trend is not recommended as it can result in significant losses. If we open short positions at the resistance level in an ascending trend, we risk closing them via stop-loss if the price does not drop to the local minimum again.

Therefore, in an ascending trend, we open long positions, and in a descending trend, we open short positions. And under no circumstances should we do the opposite! Although this tactic may not seem complex at first glance, the key lies in identifying the trend. After all, the same chart can be interpreted differently, and clear, classic trends do not occur frequently on the chart. The support (resistance) line does not always precisely touch the price chart's extremes, and different scales and timeframes can be used when analyzing charts. Therefore, trading along the trend requires a creative and meticulous approach to trading.

Part V. Sophisticated Trading Tactics / Chapter 2. Trading Along a Horizontal Range

Many trading books recommend against trading in a calm market when prices fluctuate within a horizontal range. After all, as they say, calm often comes before the storm, and a storm can lead to significant losses. Nevertheless, professional currency traders do not miss a single opportunity to profit because they can generate profits with equal efficiency in both calm and rapidly changing markets.

Trading within a horizontal range primarily involves identifying the range on the chart. Classic horizontal ranges occur very rarely on charts, so approaching this process requires a creative mindset. Once a horizontal range has formed and been confirmed over time, trading can begin. Buying should be done at the lower boundary of the price range, and selling at the upper boundary. Additionally, closing one position can be accompanied by opening an opposing position, allowing you to maximize profits within the horizontal range.

It is advisable to associate a horizontal range with a dormant fire-breathing dragon that can awaken at any moment. A breakout from a horizontal range can be so unexpected and powerful that without proper precautions, it can eat away a significant portion of your trading account. Therefore, when trading within a horizontal range, always set stop-loss and take-profit levels, or else you risk losing a considerable amount, if not all, of your capital.