- AME CAPITALS

- Trading Technology

- Help AME Trading

Chapter 10. Margin Trading

In the previous chapter, trading on the Forex market was compared to the possibility of earning profits through currency exchange in an exchange office. It was shown that Forex has a number of advantages that allow for significant earnings in a short period of time. The fundamental advantage underlying such earnings is margin trading, which was first introduced in Forex in 1986.

Margin trading allows investors with relatively small capital to participate in the Forex market. Without it, private investors would not be able to trade on the currency exchange, as the minimum contract size in Forex (one lot) is approximately $100,000. The principle of margin trading is as follows: the brokerage firm (Internet broker or dealing company) provides credit to its clients for currency speculation, using the client's funds as collateral, which is referred to as margin. The size of the margin typically ranges from 1-5% of the client's trading volume on Forex and depends on the leverage offered. Leverage can be 1:20, 1:50, 1:100, or even 1:200, depending on the specific conditions of the Internet broker.

This means that with a margin of $1,000, a client can obtain credit ranging from $20,000 to $200,000 for trading on Forex. By conducting trades with larger sums, we can potentially earn greater profits. However, since these trades are conducted with borrowed funds, the risk of losses increases proportionally to the potential income. In other words, we can double the amount in our account as quickly as we can lose it all.

As we mentioned before, credit is provided based on the collateral of the margin deposit, also known as a guarantee deposit or margin (hence the name margin trading). This means that when a client receives credit for currency speculation in the Forex market, they are risking only their own funds. The client cannot lose more than the amount available in their margin deposit. In this regard, companies that provide brokerage services in the international currency market are fully protected.

What is the incentive for Internet brokers (dealing companies) to provide credit for Forex trading? There are several sources of income for such companies, which we will discuss in detail.

Indeed, there are several ways in which these companies generate income.

Firstly, they may charge a commission for each transaction executed by the client. This means that a certain amount is deducted from your account when you close a position, regardless of whether the trade resulted in a profit or a loss.

Secondly, such companies earn from the spread. They provide their clients with a slightly wider spread compared to the actual market quotes. When executing trades on behalf of the client, the company uses its own funds (essentially providing you with credit) and operates on the quotes provided by the bank. Clients receive quotes adjusted in favor of the Internet broker.

These practices allow the companies to generate revenue from the commissions and the difference in spreads, thereby profiting from the trading activities of their clients.

In addition, there are a few more ways in which these companies generate income:

Thirdly, if a client is trading with mini or micro lots, they are essentially "playing" against the Internet broker because mini and micro lots are not traded at the interbank level. In the case of profits, the funds are paid directly by the Internet broker, but in the case of losses, the Internet broker receives your funds. Since this profit model employed by dealing companies works, it can be inferred that the majority of beginner traders trading with mini and micro lots end up losing their money. To avoid repeating their mistakes and being part of that "majority," thoroughly study Forex before starting to trade with a real account.

Fourthly, the company may charge interest on the credit extended to you. This means that for the total amount of open positions carried forward to the next day (i.e., not closed by the end of the day), interest is charged for the use of the credit. In the best case scenario, this would be the benchmark interest rate, which is the rate at which the central bank lends to commercial banks in the country. In this case, it is referred to as the overnight interest rate (discussed in detail in the relevant chapter). Different countries have different interest rates, so depending on the currency of the open positions and the type of transaction (buy or sell), the overnight interest may be charged to or credited to the client.

That's correct. In margin trading, there is no actual delivery of currencies, and the value date becomes irrelevant. Internet traders profit from speculating on the price movements of currency pairs by opening positions at one price and closing them at another. Traders can trade with any currency pair, not limited to the currency of their deposit. Moreover, traders can take both long and short positions on the currency pairs they are interested in. All profits and losses are calculated and converted into the currency of the deposit.

Let's consider the principle of margin trading with an example. Suppose you are trading with mini lots and expecting the USD/JPY exchange rate to increase. You have $2,000 in your account, and the size of one mini lot is equivalent to $10,000. Let's assume your Internet broker provides you with a leverage of 1:50. This means that to open a position, you would need a margin deposit of $200 (since $200 x 50 = $10,000). At the moment you open a long position, the margin deposit amount is frozen on your account, and only $1,800, known as the free margin, remains available for you to use. You can use this free margin to open other positions./p>

It is not recommended to leave too little free funds in your account. The reason is that once you open a position, fluctuations in the USD/JPY exchange rate can temporarily move against you. If you were to close the position at that moment, you would incur losses that would be deducted from your account. The Internet broker cannot allow your losses to exceed the size of your account, as that would require them to cover the losses from their own pocket. Therefore, as soon as your current (floating) losses reach a point where your account is unable to cover them, your position will be automatically closed or blocked by the Internet broker (position blocking, also known as lock position, will be discussed in the Forex University section). This automatic closure of the position is preceded by a so-called margin call, which will be explained in detail in the next chapter. Thus, the larger the amount in your account, the larger the fluctuations in the exchange rate of your open position you can withstand, avoiding a margin call. The direction of the exchange rate can change in your favor and bring you profits, but if the size of your account cannot withstand temporary adverse fluctuations in the exchange rate, you will incur losses.

It should be noted that the more positions (lots) you open, the more free funds should be available in your account. If, in our example of the USD/JPY, we were to open not just one lot but four lots, the margin deposit would be $800 instead of $200. Therefore, the free portion of the account would be $1,200. Since temporary losses in the exchange rate would now affect all four open positions, the chance of receiving a margin call increases proportionally, four times higher. Such a situation will be discussed in detail in the next chapter.

So, margin trading provides several advantages to the novice Internet trader. With a skillful approach to trading, it can become a source of increasing your income. However, on the other hand, increasing the potential profit also means an increase in the risk of losses. Therefore, margin trading is a "double-edged sword." It can make you very wealthy or very poor. Your intelligence, practical experience in Forex trading, and a bit of luck are what determine your success!

Chapter 11. Margin call

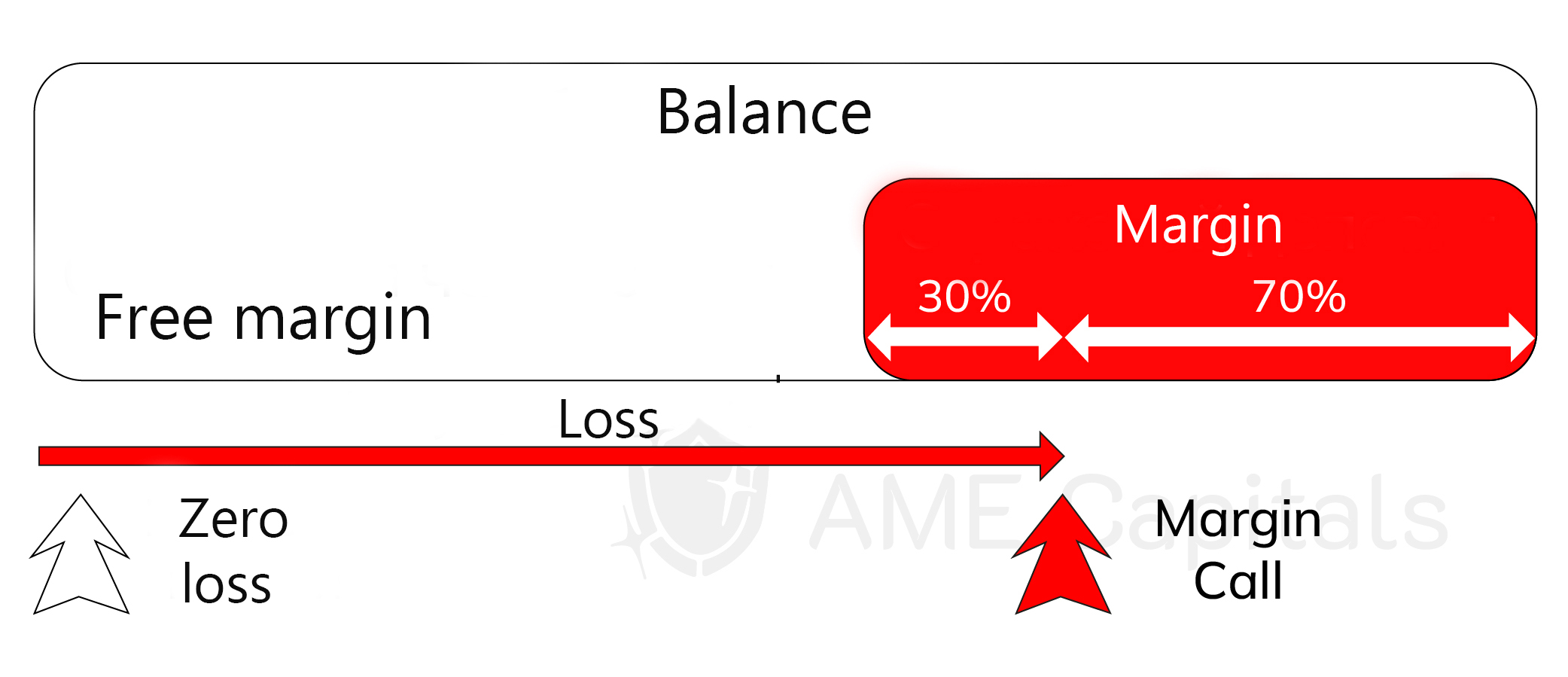

In the Forex market, when a trader opens a position using the services of an internet broker (dealing company), a portion of the funds in their account is frozen. This portion is called the margin deposit and is used to ensure that the trader will never lose more funds than what is available in their account. The unfrozen funds are referred to as the free margin and can be used to open new positions.

It is highly discouraged to use the entire account balance to open positions because the free margin is also used to support current losses, known as temporary losses, on open positions. These losses become realized losses if the position is closed at the current moment.

If a client does not have sufficient funds to cover the current losses on their positions, a margin call is triggered. This serves as a warning that additional funds need to be deposited into the account. If the client fails to meet the margin call by adding funds, the broker will automatically close the positions, and the client will incur real losses.

Current losses can occur due to unexpected movements in the exchange rate that go against the client's open position. For example, if a client opens a long position on the USD/JPY currency pair, expecting the US dollar to increase in value against the Japanese yen, but the US dollar starts to decline instead, the client may experience temporary losses.

So under what circumstances does margin call occur?

The amount in the account is divided into the margin deposit and the free account balance. The size of the margin deposit depends on the leverage provided by the dealing company (discussed in the previous chapter), the type of lots the trader is trading, and the number of such lots. In the case of a leverage of 1:50 and a long position on USD/JPY opened with one mini lot (10,000 USD), the margin deposit would be 10,000 / 50 = 200 USD. If there were 1,000 USD in our account, 200 USD would be frozen as the margin deposit, and 800 USD would be available for us to use.

From the moment a position is opened, current profits or losses start to accumulate as the exchange rate between the dollar and the yen constantly fluctuates. Let's say the current losses amount to 800 USD, meaning that if we were to close the position, we would incur losses of 800 USD. However, the position is still open, and the exchange rate could turn in our favor, resulting in profits. We still believe that opening a long position was the right decision. But the dealing company understands that if the current losses exceed the size of our account, they would have to cover the losses from their own pocket, which they naturally wouldn't agree to. Since currency exchange rates in Forex can change rapidly, it is difficult to pinpoint the exact moment when your current losses will match the exact amount in your account. Dealing companies take precautions in this regard. Therefore, as soon as your current losses surpass a certain portion of your margin deposit, a margin call is triggered, and all your open positions are automatically closed. Only the unaffected portion of your margin deposit remains in your account, which becomes the free account balance. Each internet broker has its own rules regarding the threshold for current losses that trigger a margin call. In the example shown, the threshold is set at 30% of the margin deposit. This means that in the event of a margin call, only 70% of the margin deposit remains in your account. In our example, if a margin call occurs in the long position on the US dollar, there would be 0.7 * 200 = 140 USD remaining in our account. Such an amount would not be sufficient to open another position, so additional funds would need to be deposited into the account.

What fluctuation in the exchange rate is required for a margin call to occur?

Let's assume that the exchange rate for USD/JPY at the time of opening a long position was 104.75/85. This means we bought dollars at a rate of 104.85 yen per dollar. The position is closed by selling dollars for yen and calculating the profits/losses in USD. Assuming a constant spread size of 10 pips, we want to find the exchange rate at which a margin call occurs.

From this equation, we find that X is approximately 95.76. This means the exchange rate for USD/JPY at which a margin call occurs is USD/JPY 95.76/86. We can observe that the exchange rate would need to decrease by around 900 pips for a margin call to be triggered. In practice, it would take a significant amount of time for such a large change in the exchange rate to occur, making it unlikely to experience a margin call.

Now, let's consider the scenario of opening a position with four mini lots (worth $40,000). In this case, the margin deposit would be $800, and the available equity would be $200. The equation becomes:

4 * 10 000 * (104.85 – X) / (X + 10) = 200 + 0.3 * 800

Solving for X, we find that X is approximately 103.6. Thus, the exchange rate for USD/JPY at which a margin call would occur in this scenario is approximately 103.60/70. We can observe that even a small fluctuation of around 100 pips would lead to a margin call. It's worth noting that a 100-pip fluctuation within a trading day is a common occurrence in Forex. This example highlights that the larger the sum of your open positions and the smaller the remaining funds in your account's available equity, the higher the likelihood of experiencing a margin call. It is important to approach this situation with seriousness and caution.

From the above discussion, it may seem necessary to constantly monitor all open positions and close them in a timely manner to minimize losses if the exchange rate moves unfavorably. However, to relieve Internet traders from the need for constant market monitoring, the concept of a limit order was introduced. With a limit order, you can set threshold values for current losses (stop-loss order) and current profits (take-profit order) at the time of opening a position. Once the current profits or losses exceed the specified thresholds, the position will be automatically closed. Unlike a market order, which is an instruction to open or close a position at the current market price, limit orders limit potential losses and define your expected profit. These terms will be discussed in more detail in the Forex University section.

As an internet trader, you should fear margin calls like fire because they can simply ruin you. Therefore, actively avoid situations where a large portion of your account is frozen as a margin deposit and ensure that you always have sufficient funds in your free account balance. Avoid opening positions using all the available funds in your free account balance and utilize limit orders to limit potential losses and define your expected profit. By doing so, you can mitigate the risks associated with margin calls and protect your trading capital.