- AME CAPITALS

- Trading Technology

- Help AME Trading

Chapter 4. Types of Conversion Operations

The concept of conversion operations on Forex is closely intertwined with the terminology of financial instruments. In financial markets, which include not only Forex but also the gold market, credit market, and securities market, financial instruments refer to the means of conducting financial transactions. In this chapter, we will focus exclusively on the financial instruments related to the international currency market, Forex. Other financial markets and their financial instruments are beyond the scope of the Forex Arena informational portal and will not be discussed further.

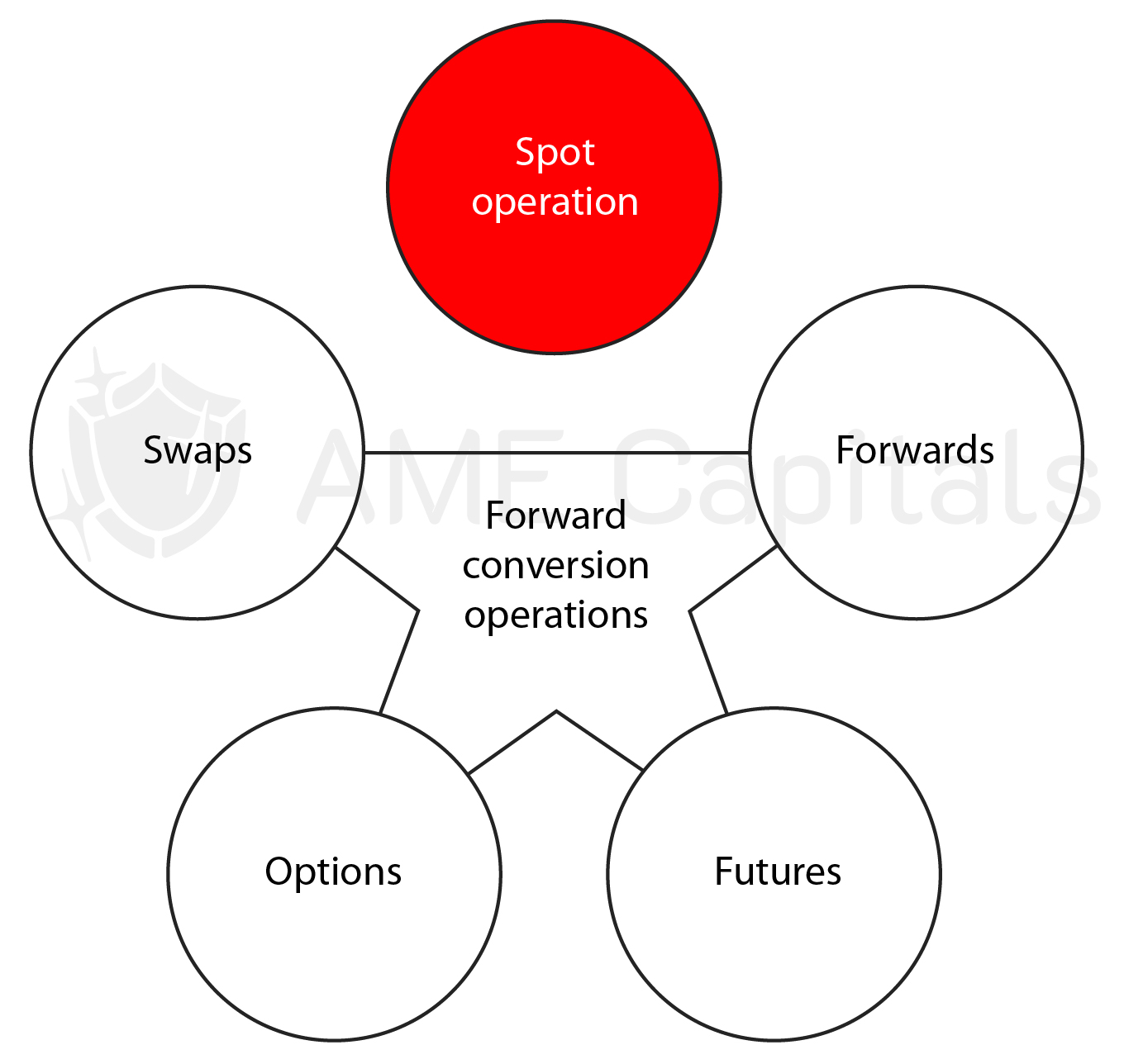

A conversion operation on Forex refers to a transaction between participants involving the exchange of a specified amount of one country's currency for another country's currency at a predetermined rate on a specific date. Conversion operations on Forex differ in terms of value date, which is the date of currency delivery relative to the date of the transaction (buying/selling of the currency). Based on this criterion, conversion operations can be divided into two categories, as shown in the diagram:

- Spot operations, also known as current conversion operations

- Forward conversion operations

Spot operations comprise the largest volume of transactions on Forex. The Forex Arena informational portal focuses specifically on trading activities related to spot operations. In international practice, the value date for spot operations is typically set as the second business day after the transaction is concluded. These conditions are convenient for the counterparties (participants) of the transaction, as it allows sufficient time to process all necessary documentation and complete the payment procedures. The market where currency is exchanged based on current (spot) rates is referred to as the spot market.

It is worth noting that the principle of settlement for spot transactions is applicable primarily to large participants in the international foreign exchange market. For individual investors (clients of retail brokerage firms) trading Forex online, transactions are executed instantly with a click of a mouse. In such transactions, the concept of value date becomes less significant, as the client's account always reflects the current state of their trading activity on Forex.

Forward conversion operations include forwards, futures, options, and swaps. These are also known as derivative financial instruments. These financial instruments have been specifically designed for real businesses to mitigate potential risks arising from future changes in exchange rates on the international foreign exchange market. For individual investors seeking to earn profits on Forex through online trading, these financial instruments hold less significance. However, they will be discussed to provide an understanding of the overall picture of conversion operation types.

Forward contracts, also known as forwards, are agreements between parties to exchange a specified amount of currency at pre-agreed rates on a predetermined date (value date). The transaction will take place regardless of the prevailing spot prices on the Forex market on the value date. The size of the contract, exchange rates, and value date can vary depending on the agreement reached between the counterparties.

Forward contracts in Forex can be useful in scenarios such as when a Russian company plans to purchase equipment in US dollars from abroad. Suppose the company currently lacks sufficient funds to execute the transaction but expects to receive ruble-denominated funds into their account within a month. They also anticipate unfavorable changes in exchange rates, i.e., an appreciation of the US dollar. In this case, it makes sense for the company to enter into a forward contract with a bank to buy the required amount of US dollars with a value date in one month at favorable rates. Naturally, the bank may not agree to such conditions if they also anticipate an appreciation of the US dollar, and finding a counterparty for such a deal may become a challenging task.

Forward contracts, on the one hand, minimize risks, but on the other hand, they can be a source of missed profit. In the previous example, if, after a month, the US dollar depreciates instead of appreciating, the company would miss out on potential profit. The company could have paid a lesser amount in rubles for the equipment.

Futures, unlike forward contracts, have standardized maturity dates (settlement dates) and fixed quantities of currency. This characteristic allows them to be traded as regular securities. There is a separate market for trading Forex futures, known as the futures market. The average duration of a futures contract in such a market is approximately 3 months.

Options, similar to futures, provide flexibility by reducing the obligations of one party in the transaction. When purchasing a futures contract, you are obligated to fulfill the terms of the transaction. However, with options, you have the choice to opt out of the transaction at your discretion. Options on Forex are also traded on a separate market known as the options market.

Swaps are a type of conversion operation in which the parties enter into a transaction to buy/sell a specific amount of currency with the obligation to execute the opposite transaction at a predetermined interval in the future. For example, a company purchases 1,000 US dollars for rubles at the current (spot) exchange rate from a bank, with the commitment to sell 1,000 US dollars for rubles back to the bank in a month at the prevailing (spot) exchange rate on the Forex market at that time. Swaps are non-standardized contracts, so they are not traded on a separate market.

Among all the described conversion operations (financial instruments), spot operations on the spot market (spot market) hold the greatest importance for individual investors who wish to earn money on Forex through the Internet. It is the spot Forex market that is extensively covered in the subsequent chapters of the Forex Arena informational portal.