- AME CAPITALS

- Trading Technology

- Help AME Trading

Part II. Technical Analysis / Chapter 18. Elliott Waves

It is no secret that many phenomena and processes in life have a cyclical nature. We have all heard the expression that history repeats itself in a spiral, and events that have already occurred in the past repeat in their new incarnation. Financial markets are no exception in this context. In this chapter, we will explore Elliott Waves as one of the tools in wave analysis in the Forex market.

In one of the previous chapters, we discussed Dow Theory, which forms the foundation of technical analysis in financial markets. This theory was further developed by accountant Ralph Nelson Elliott and received further elaboration in his monograph "The Wave Principle," which was published in the 1930s. Initially, Elliott Waves were created for analyzing liquid assets in the stock market but later found successful application in analyzing the Forex market as well.

Elliott began developing his theory after retiring, attempting to find patterns in the seemingly chaotic market movements. He undertook a colossal effort, the result of which was the formulation of mass psychology among market participants. Elliott concluded that the behavior of market quotes is determined by a certain cyclicality, based on the psychology of traders' behavior in the market. According to the author, this cyclicality is expressed in the appearance of waves on the price charts of market assets, which became known as Elliott Waves.

According to Elliott's wave theory, the market can be in two states or phases - bullish and bearish. The current market phase is determined by its trend. Elliott concluded that any movement in financial markets is divided into five waves in the direction of the main price trend, and three corrective waves in the opposite direction. To understand the above, let's consider a diagram that illustrates the development of a situation in a bullish market.

All Elliott waves are divided into two types: impulse waves and corrective waves. In the diagram under consideration, waves 1-5 are the primary waves in the market with a predominant bullish sentiment. Three of them (1, 3, and 5) are impulse waves as they occur in the direction of the main movement, while the remaining two (2 and 4) are corrective waves. Waves A-C are corrective waves, with two of them (A and C) being impulse waves as they confirm the corrective movement. Wave B is a corrective wave within the correction.

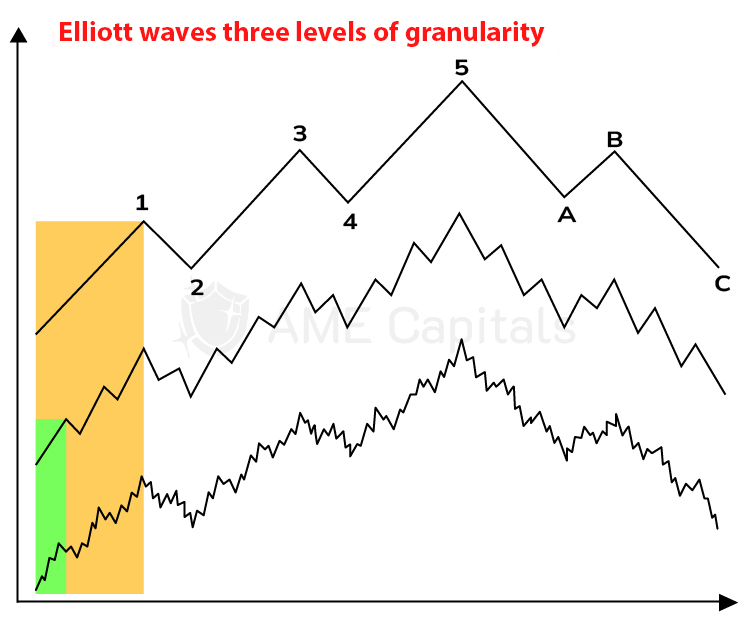

One important property of Elliott waves is the principle of nestedness. Any wave can be subdivided to a certain extent into smaller waves and can also be part of a larger wave. Impulse waves are subdivided into five primary waves, while corrective waves are subdivided into three corrective waves.

Elliott identifies the longest cycle in his theory and calls it the "Grand Supercycle," which consists of 8 waves. Each of these waves is further subdivided into a series of smaller waves, creating a hierarchical structure. However, it should be noted that it is not always possible to clearly identify Elliott waves in the market – the theory often contradicts practical application.

By analyzing a large dataset, the author of the wave theory concluded that Elliott waves exhibit certain regularities. Specifically, the lengths of waves within a series are often interrelated. To express these relationships, Fibonacci numbers are commonly used, which will be discussed in one of the upcoming chapters.

The lengths of Elliott waves often exhibit certain relationships. Here are some commonly observed ratios:

Wave 2 is often 0.382, 0.5, or 0.618 of the length of Wave 1.

Wave 3 is often 0.618, 1.618, or 2.618 of the length of Wave 1.

Wave 4 is often 0.382 or 0.5 of the length of Wave 1.

Wave 5 is often 0.382, 0.5, or 0.618 of the length of Wave 1.

Wave A is often 0.618, 0.5, or 1 of the length of Wave 5.

Wave B is often 0.382 or 0.5 of the length of Wave A.

Wave C is often 0.618, 0.5, or 1.618 of the length of Wave A.

While these ratios are commonly observed, it's important to recognize that they are conditional. In addition to the mentioned relationships, the ratio of Elliott wave sizes to any other wave in the cycle can also be expressed through Fibonacci numbers. The size of an Elliott wave can refer to its height on a price chart or its duration. Each wave has its own characteristics, which will be discussed further, using the example of a bullish market.

Wave 1 occurs when the market is predominantly bearish, and financial news still favors the bears. This wave is typically very strong, especially if it is accompanied by significant changes in technical or fundamental aspects (such as a breakout of a resistance line or unexpected interest rate changes). If there are no major market shifts, Wave 1 represents a minor impulse movement.

Wave 2 occurs as a retracement from the recently achieved bullish positions. This retracement can almost neutralize the price movement achieved in Wave 1, but it usually does not go below its starting point. Wave 2 can be explained by nervous bulls taking profits and fearing a reversal. The length of Wave 2 is typically around 50-70% of Wave 1.

Wave 3 is the most sought-after wave by Elliott wave theorists. "Catching this wave" can yield maximum profits. This wave is characterized by a sharp surge in optimism among professional traders. In 90% of cases, Wave 3 is the most powerful and longest wave, experiencing the highest acceleration in prices. Typically, Wave 3 is accompanied by increased trading volume. In a classic scenario, Wave 3 surpasses Wave 1 by at least 1.618 times.

Wave 4 corrects the rapid price rise in the opposite direction. Although identifying this wave on historical charts is not very challenging, determining its beginning in real-time can be difficult. The retracement typically occurs within a range of approximately 35-45% of the length of Wave 3, and the duration of the corrective movement is relatively short. In a classic scenario, Wave 4 should not overlap with Wave 2.

Wave 5 is often characterized by a lack of confirmation through increasing trading volumes. Sometimes it is referred to as an impulse divergence, meaning that the price increases on decreasing or average volumes. Towards the end of Wave 5, trading volumes increase again. At this stage, the primary movement (along the established trend) concludes, and a series of corrective waves follow.

Wave A is characterized by a market situation where bulls begin to profitably unwind their positions. Players inclined to forecast further price declines enter the market. This wave is impulsive and shares similar properties with the previously discussed Wave 1 but in the opposite direction.

Wave B is the counterpart of Wave 4 in the opposite direction and can also be challenging to identify in real-time. This wave is characterized by residual upward price movement driven by the few remaining bulls who believe in further price growth of the underlying asset.

Волна C Wave C represents a sharp impulsive downward movement amid growing bearish sentiment. In a classic scenario, this wave's length exceeds that of Wave 3. Towards the end of this wave, bulls reappear in the market, willing to take risks.

While it all looks good in theory, Elliott Waves can be challenging to identify in practice. Market behavior doesn't always align with the described patterns, and what may be clear on historical data is often blurred in real-time analysis. We have only discussed the classical pattern of wave alternation. However, there are numerous non-standard wave configurations and actionable recommendations. Elliott Waves are commonly analyzed using chart patterns (trend reversal patterns and trend continuation patterns) that we have previously discussed. We have only touched upon the basics of Elliott Wave theory, and for more detailed information, it would be advisable to refer to specialized literature.