- AME CAPITALS

- Trading Technology

- Help AME Trading

-

Help

- 1 — User Manual

- 2 — Trading

- 3 — Analytics

- 4 — AME AutoTrading

- 5 — Mobile trading

-

Getting Started

- 1 — Key elements of the platform interface

- 2 — How to open a demo account

- 3 — How to make the first trade

- 4 — Additional trading features

-

General Principles

- 1 — General Principles

- 2 — The Connection between Orders, Trades, and Positions

- 3 — General scheme of trading operations

- 4 — Position accounting systems

- 5 — Netting System

- 6 — Hedging system

- 7 — Impact of the Position Accounting System

- 8 — Types of Orders

- 9 — Market Order

- 10 — Pending Order

- 11 — Take Profit

- 12 — Stop Loss

- 13 — In the Netting system

- 14 — In the Hedging system

- 15 — Trading Stop

- 16 — The Trading Stop works as follows

- 17 — Order Status

- 18 — Types of execution

- 19 — Execution Policies

-

Market Overview

- 1 — Viewing Quotes of Financial Instruments

- 2 — Quick Addition of Symbols

- 3 — Sorting Symbols

- 4 — Analysis by Sectors and Industries

- 5 — Viewing Fundamental Data

- 6 — Viewing Trading Statistics of Financial Instruments

- 7 — Managing Symbols

- 8 — Relevance of Trading Instruments

- 9 — Commission

-

Placing Trades

- 1 — Opening Positions

- 2 — Placing an Order and General Parameters

- 3 — Managing Positions

- 4 — Where to view current open positions

- 5 — Modifying a Trade

- 6 — What is a Trading Stop and how to set it

- 7 — Closing Positions

- 8 — Setting Pending Orders

- 9 — Setting Limit Orders

- 10 — Setting Stop Orders

- 11 — Managing Pending Orders

- 12 — Alerts and Favorite Trading Pairs

Trading Platform - User Manual

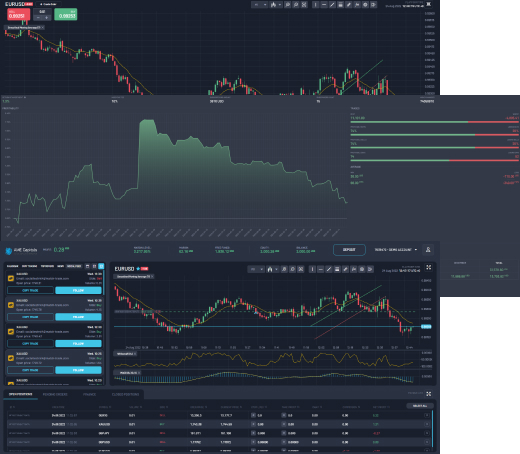

A trading platform is a trader's working tool that enables trading operations on financial markets. The platform includes everything necessary for successful internet trading: trading, technical analysis of quotes, fundamental analysis, automated trading, and the ability to trade from mobile devices. Additionally, traders can work not only with Forex instruments but also engage in options, futures, and stock trading on the exchange.

All types of trading orders, quote charts, technical and fundamental analysis, algorithmic trading, and mobile trading.

Trading

The platform offers a wide range of tools for conducting trading activities. There are four modes of order execution available:

- Instant Execution,

- Request Execution,

- Market Execution,

- Exchange (for trading on stock exchanges).

Traders have access to all types of orders, including market orders, pending orders, and stop orders. This variety of order types and execution modes allows traders to implement almost any trading strategy for successful trading on the forex market or stock market.

In addition, the platform provides features for trading directly from the chart and one-click trading.

Analytics

The trading platform offers powerful analytics tools. For analyzing currency or stock quotes, the program provides 82 different analytical instruments, including technical indicators and graphical objects.

The built-in technical indicators are not the only analytical tools available in the trading platform. In addition to those, traders can access a free database of technical indicators and an automated trading system.

For each instrument, there are 21 timeframes available, ranging from one minute to one month. Traders can simultaneously open up to 100 charts of financial instruments.

AME AutoTrading

AutoTrade, also known as automated trading or algorithmic trading, allows traders to formalize and implement almost any trading strategy in the form of a trading advisor (robot), which can trade automatically on their behalf. These trading robots do not get tired or experience emotions like humans do. Instead, they strictly follow the programmed algorithm and can react much faster to market changes. Automated trading can be particularly beneficial for executing trades based on predefined criteria without the need for constant manual monitoring. It enables traders to take advantage of trading opportunities in real-time, even when they are not actively present at the computer. However, it is essential to develop and thoroughly test the trading strategy before deploying it in live markets to ensure its effectiveness and minimize potential risks.

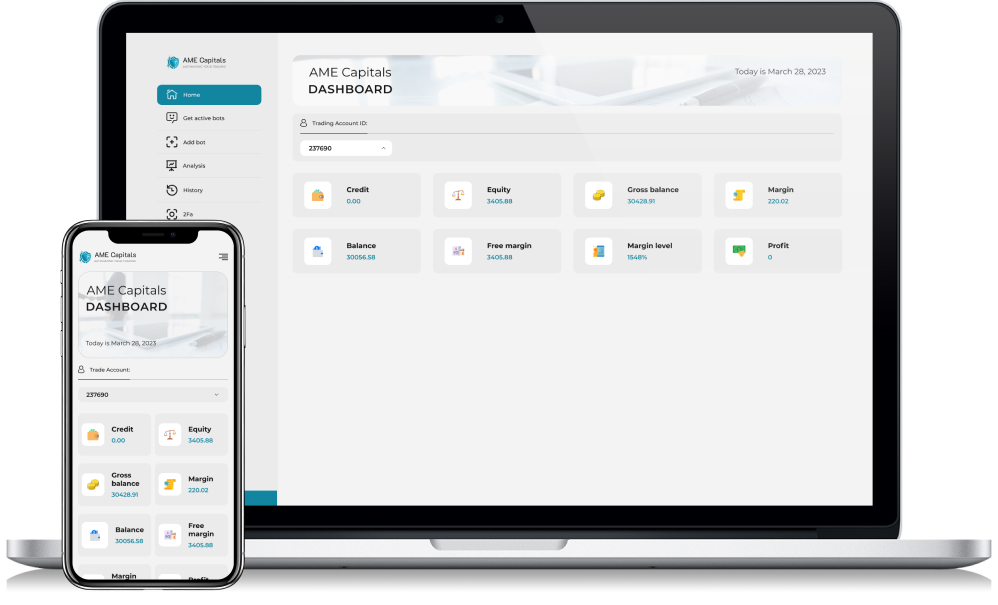

Mobile trading

Smartphones and tablets are indispensable in trading when you are away from your computer. Use the AME Capitals trading platform on your iPhone/iPad and Android devices to trade on financial markets. Mobile trading provides traders with a convenient opportunity to trade on financial markets using their smartphones and tablets, even when they are away from their computers. By installing the AME Capitals trading platform on iPhone/iPad and Android devices, traders can access their trading accounts and markets, allowing them to monitor current quotes, analyze charts, and execute trades in real-time. Mobile trading provides flexibility and freedom for traders, enabling them to react to market changes at any time and from anywhere.

The functionality of mobile trading platforms will pleasantly surprise you - full support of trading features, extensive analytical capabilities with technical indicators and other graphical tools, and, of course, all of this is available from anywhere in the world, 24 hours a day.

With the mobile platform, you can also read financial news and internal emails, as well as exchange instant messages with any members of the most popular AME Capitals traders' community.