- AME CAPITALS

- Trading Technology

- Placing Trades

-

Help

- 1 — User Manual

- 2 — Trading

- 3 — Analytics

- 4 — AME AutoTrading

- 5 — Mobile trading

-

Getting Started

- 1 — Key elements of the platform interface

- 2 — How to open a demo account

- 3 — How to make the first trade

- 4 — Additional trading features

-

General Principles

- 1 — General Principles

- 2 — The Connection between Orders, Trades, and Positions

- 3 — General scheme of trading operations

- 4 — Position accounting systems

- 5 — Netting System

- 6 — Hedging system

- 7 — Impact of the Position Accounting System

- 8 — Types of Orders

- 9 — Market Order

- 10 — Pending Order

- 11 — Take Profit

- 12 — Stop Loss

- 13 — In the Netting system

- 14 — In the Hedging system

- 15 — Trading Stop

- 16 — The Trading Stop works as follows

- 17 — Order Status

- 18 — Types of execution

- 19 — Execution Policies

-

Market Overview

- 1 — Viewing Quotes of Financial Instruments

- 2 — Quick Addition of Symbols

- 3 — Sorting Symbols

- 4 — Analysis by Sectors and Industries

- 5 — Viewing Fundamental Data

- 6 — Viewing Trading Statistics of Financial Instruments

- 7 — Managing Symbols

- 8 — Relevance of Trading Instruments

- 9 — Commission

-

Placing Trades

- 1 — Opening Positions

- 2 — Placing an Order and General Parameters

- 3 — Managing Positions

- 4 — Where to view current open positions

- 5 — Modifying a Trade

- 6 — What is a Trading Stop and how to set it

- 7 — Closing Positions

- 8 — Setting Pending Orders

- 9 — Setting Limit Orders

- 10 — Setting Stop Orders

- 11 — Managing Pending Orders

- 12 — Alerts and Favorite Trading Pairs

Placing Trades

Trading Activity in the platform involves the formation and submission of market and pending orders for execution by the broker, as well as the management of current positions through modification or closure. The platform allows convenient viewing of trading history on the account, setting up market event notifications, and much more.

Opening Positions

Opening a position or entering the market involves the initial purchase or sale of a specific volume of a financial instrument. In the trading platform, this can be done by placing a market order, which results in a transaction. A position can also be opened when a pending order is triggered.

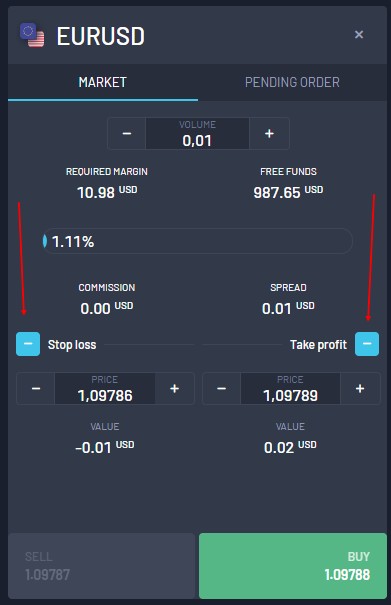

Placing an Order and General Parameters

To open a position or enter the market, you can place a market order through various methods. In the left panel, you will find the "Create Order" button.

Let's consider the general parameters of an order:

Symbol — the name of the financial instrument on which the transaction is being made.

Type — if one of the execution modes is selected in this field, a market operation is performed with the chosen instrument. Otherwise, a pending order of the selected type is placed.

Volume — оthe order volume in lots. The larger the volume of the trade, the greater the potential profit or loss depending on the direction of the instrument's price. The trade volume also affects the amount of funds (margin) reserved on the trading account to support the position.

About Stop Loss — The Stop Loss level is set in prices or in the number of points from the price specified in the order, depending on the platform settings. This level is used to limit losses on a position. If you leave this field blank, the Stop Loss order will not be attached to the trade. ;

About Take Profit — The Take Profit level is set in prices or in the number of points from the price specified in the order, depending on the platform settings. This level is used to fix profits on a position. If you leave this field blank, the Take Profit order will not be attached to the trade. ;

Comment — This is an optional text comment for the order. The maximum length of the comment is 31 characters. The comment is displayed in the list of open positions, as well as in the history of orders and trades. The comment for the order may be changed by the broker or server, for example, when the position is closed by Stop Loss or Take Profit, relevant information will be indicated in the comment.

To place a buy order, click the Buy button; to place a sell order, click the Sell button.

After sending the order, the window will show the result of its execution — either a successful trade or a rejection with an explanation of the reason why it was not executed. If the "One-Click Trading" option is enabled in the platform settings, the trading window will be closed immediately after a successful execution without notifying about the result.

Now let's consider the features of trading in different execution modes. This depends on the type of instrument and the broker.

Managing Positions

An important aspect of trading in financial markets is the effective management of positions on the account, and the trading platform provides all the necessary tools for this.

Where to view current open positions

The list of current open positions is displayed at the bottom in the "Open Trades" tab. If desired, you can expand the tab to view more trades.

Here, all the parameters of the positions are shown, including the financial instrument, type, volume, current profit/loss, and other details. Additionally, the current status of the trading account and the overall financial result of all open positions are displayed.

Summary information about the asset status for all open positions can be viewed on the "Assets" tab.

Modifying a Trade

To modify the stop loss or take profit order, click the "+" sign in the corresponding column. In the pop-up window that appears, make the desired changes and click the "Save" button.

What is a Trading Stop and how to set it

A "Stop Loss" is used to minimize losses in case the price of a financial instrument starts moving in an unfavorable direction. When an open position becomes profitable, the "Stop Loss" can be manually moved to a breakeven level. To automate this process, a Trading Stop is used. This tool is particularly useful during strong one-directional price movements or when it's not possible to closely monitor market conditions.

The Trading Stop is always associated with an open position or a pending order. It is executed in the trading platform, not on the server like the regular "Stop Loss." To set it, execute the "Trading Stop" command from the context menu of the position or order in the "Trading" tab:

Choose the desired distance between the Trading Stop and the current price level.

Closing Positions

To realize the profit from the price difference, it is necessary to close the position. Closing a trading position is the opposite of the initial trade operation. For example, if the initial trade was a purchase of one lot of GOLD, then to close the position, you need to sell one lot of the same financial instrument.

To close a trade, click on the cross in the right part of the open trade and then click the "Close" button in the pop-up window.

Setting Pending Orders

A pending order is an instruction from a brokerage company to buy or sell a financial instrument in the future under specified conditions. For example, if you want to sell EURUSD at the price of 1.10800, but the price has not reached that level yet, you don't have to wait. You can place a pending order, and the brokerage company will execute it, even if the trading platform is turned off at that moment.

Setting Limit Orders

Limit orders are set for a "bounce." Traders expect the price to reach a certain level, such as a support or resistance level, and then start moving in the opposite direction.

The key feature of such orders is that they are executed at the price equal to or better than the one specified in the order. Therefore, there are no slippages when they are executed. However, the downside is that there is no guarantee of execution; the broker may reject the order if the price has moved too far against it.

Setting Stop Orders

Stop orders are set for a "breakout." Traders expect the price to reach a certain level, break through it, and continue moving in the same direction. Essentially, the trader assumes that the market has already reversed after reaching a support or resistance level.

The key feature of such orders is that when triggered, the broker sends an execution order at the market price, which could be equal to or worse than the one specified in the order. In other words, if the market price moves against the trader, the order will be executed with slippage. However, unlike limit orders, stop orders are guaranteed to be executed.

For Buy Stop orders, it works the opposite way. They are placed in anticipation of the market already reversing, and the price is expected to rise.

Managing Pending Orders

In trading, there is often a need to modify pending orders: set a new activation price, change stop levels, or expiration dates.

To change the price of a pending order, you need to manually close the recently created pending order and recreate it with the updated parameters.

Alerts and Favorite Trading Pairs

Alerts are signals that notify traders about various events in the market. By setting up alerts, traders can step away from the monitor, and the trading platform will automatically notify them when the specified event occurs.

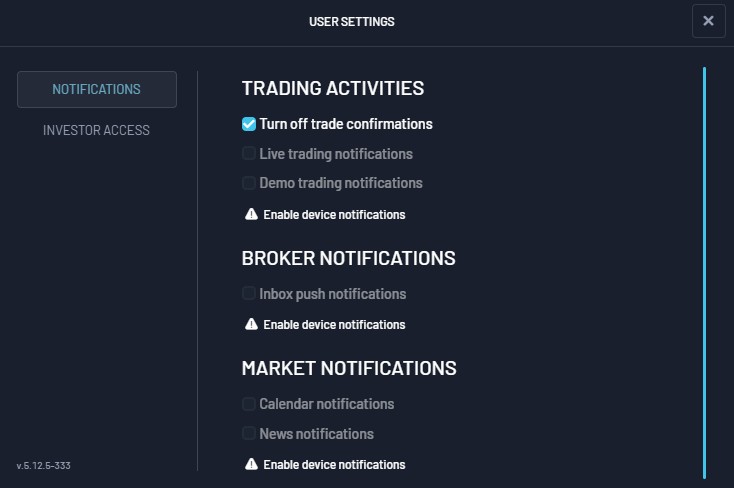

Notifications can be configured on the "User Settings" tab.

Traders also have the option to add their favorite trading pairs to the "Favorites" tab. This allows them to quickly access information about their chosen instruments without the need to search for them in the general list of all available symbols. The "Favorites" tab helps traders focus on the most important and interesting financial instruments for them.