- AME CAPITALS

- Trading Technology

- Help AME Trading

Chapter 5. Currency Quotes in Forex

When we buy goods at a store, the price tag reflects the cost of the item in units of the national currency. And we don't have any questions if we're going to buy a book priced at 100 rubles – we take the book, prepare 100 rubles, and go to the cashier.

In Forex, one currency is always traded relative to another currency, so a simple price tag is not enough. Let's assume we're dealing with the US dollar and the Euro. To assess the value of currencies, we need to know the value of one US dollar expressed in Euros or the value of the Euro expressed in US dollars. In other words, we need to know the exchange rate of one currency relative to another. Such an exchange rate is reflected in a quote of the form A/B. In our case with the Euro and the US dollar, the quote looks like EUR/USD.

The currency that appears before the "/" symbol is called the base currency, while the currency that appears after the "/" symbol is called the quote currency or counter currency. For any currency pair in Forex, the position of the currencies in the quote is strictly defined. For the Euro and the US dollar pair, it is represented as EUR/USD and never as USD/EUR in official quote listings. Thus, EUR is the base currency, and USD is the quote currency.

what determines the position of the currency in the quote? Let's take a moment to step away from Forex and consider a specific country, for example, Japan. In each country, there are historically established rules for expressing exchange rates for each foreign currency. These rules of representation are usually based on convenience. It's more convenient to say that one US dollar can be bought or sold for 104.78 Japanese Yen than to say that one Japanese Yen can be bought or sold for 0.0095 US dollars. That's why the exchange rate of the Japanese Yen to the US dollar is represented as USD/JPY, and not the other way around. The method of representing the exchange rate where the value of one unit of the foreign currency is expressed in terms of a certain amount of the national currency is called a direct quote. On the other hand, the method of representing the exchange rate where the value of one unit of the national currency is expressed in terms of a certain amount of the foreign currency is called an indirect or reverse quote. In our example, USD/JPY is a direct quote for Japan.

Since Forex does not have the concept of a national currency, and the primary reserve currency in the world is the US dollar, the rules for expressing exchange rates in the respective countries are used to denote quotes involving the US dollar. The terms direct and indirect quotes in Forex are used in relation to the US dollar. With certain currency pairs, the US dollar will be the base currency, and the quote will be indirect. With other currency pairs, the US dollar will be the quote currency, and the quote will be direct. For example, in the USD/JPY pair, the US dollar is the base currency in an indirect quote, while in the GBP/USD pair, it is the quote currency in a direct quote.

When we say that the quote of A/B is equal to X, it means that one unit of the base currency A can be bought or sold for X units of the quote currency B. In our example with the Euro and the US dollar, if we say that the EUR/USD quote is 1.2845, it means that one Euro can be bought or sold for 1.2845 US dollars. In other words, buying or selling operations always refer to the base currency of the quote. The table provides examples of Forex quotes relative to the US dollar.

| Quotation | Quote value |

|---|---|

| EUR/USD | 1.2845 |

| USD/JPY | 97.50 |

| GBP/USD | 1.6260 |

| USD/CHF | 1.1623 |

| AUD/USD | 0.6735 |

| USD/CAD | 1.2535 |

From the table, we can conclude that one Euro is sold/bought for 1.2845 US dollars, one US dollar is sold/bought for 97.50 Japanese Yen, and so on.

It is important to note that in some online quote lists, there may not be an emphasis on direct/indirect quotes, and it is assumed that the user is informed and understands which currency is the base currency in the quote. For example, you may come across a quote written as JPY/USD 97.50, although it implies an indirect quote in relation to the US dollar, i.e., USD/JPY 97.50. Sometimes quotes in relation to the US dollar are denoted by just one currency, such as JPY 97.50. Therefore, it is crucial to familiarize yourself with the currency pairs you intend to use in Forex trading and know whether the quote is direct or indirect in relation to the US dollar, i.e., you need to know the base of the quote in the pair! Otherwise, you may mistakenly make the opposite decision to buy or sell. This is particularly relevant in the case of the Swiss franc (CHF), which is always the quote currency when paired with the US dollar. So, a notation like CHF 1.1623 means that one US dollar is sold/bought for 1.1623 Swiss francs, not the other way around.

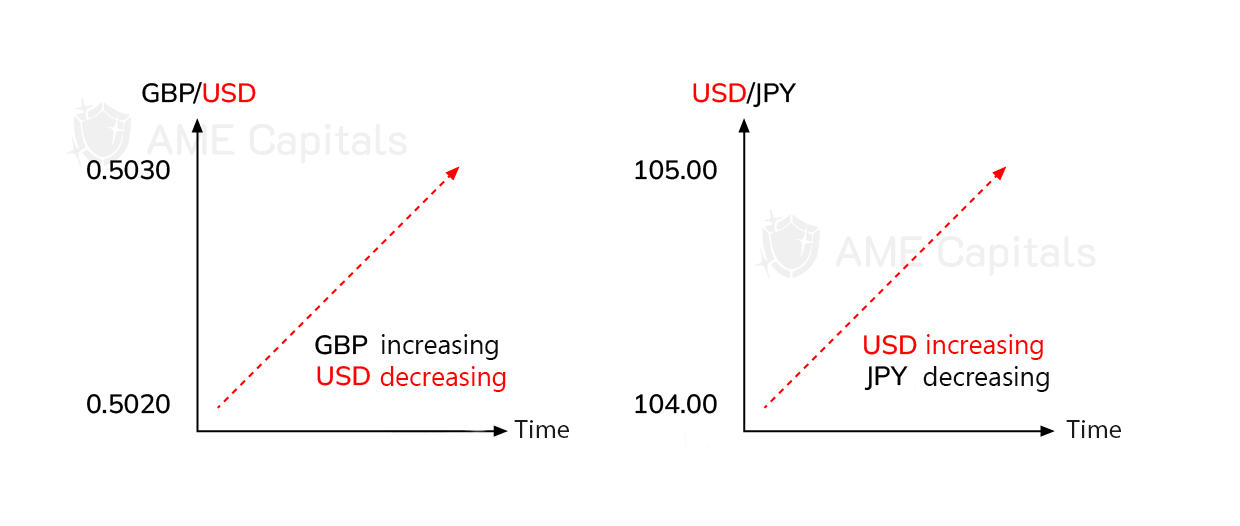

In addition to understanding the quotes themselves, it is crucial to comprehend the direction of quote changes. After all, our main goal in Forex trading, just like in any transaction, is to buy at a lower price and sell at a higher price. The direction of exchange rate movements has opposite meanings for direct and indirect quotes. For a direct quote in relation to the US dollar, such as GBP/USD, an increase in the quote signifies an appreciation of the British pound and depreciation of the US dollar. This means that you can now buy/sell one British pound for a larger amount of US dollars. Conversely, for an indirect quote in relation to the US dollar, such as USD/JPY, an increase in the quote represents an appreciation of the US dollar and depreciation of the Japanese yen. This means that you can now buy/sell one US dollar for a larger amount of Japanese yen. This is why it is important not to confuse the type of quote in relation to the currency of interest when conducting operations in Forex. This principle is illustrated in the figure, which depicts simplified graphs of quote changes.

In the table above, you can observe that different quotes have different levels of precision (varying number of decimal places). The minimum change in a quote value is called a pip (point). The pip value differs for different quotes. For example, for the EUR/USD quote, one pip is equal to 0.0001, while for the USD/JPY quote, one pip is equal to 0.01. It is worth noting that the higher digits of a quote (big figure) generally change relatively slowly over time.

Of significant interest is the value of one pip expressed in US dollars. In the case of direct quotes in relation to the US dollar, this is not a problem, as the pip is already expressed in US dollars. However, for indirect quotes in relation to the US dollar, the value of one pip in US dollars needs to be calculated using a specific formula, which will be discussed later when we learn how to calculate profits/losses from trades.

In this chapter, all quotes were expressed in spot (current) prices. We deliberately avoided complicating the material by introducing concepts such as bid price, ask price, spread, and cross-rates. These concepts will be discussed in the following chapters.