- AME CAPITALS

- Trading Technology

- Help AME Trading

Chapter 8. Forex Trading Hours

Although the Forex market operates 24 hours a day, there are specific time periods when it is more or less active in terms of trading operations with different currencies. This is influenced by the working hours of the world's major financial markets.

We are all familiar with the concept of time zones, and in this regard, Russia is a unique country as it spans across 10 time zones. This means that at any given moment, local time varies in different cities around the world, and daytime in one place may correspond to nighttime in another. To facilitate time orientation, the concept of Greenwich Mean Time (GMT), also known as world time, was introduced. GMT represents the local time in the vicinity of the Greenwich (zero) meridian and includes countries such as the United Kingdom and Portugal.

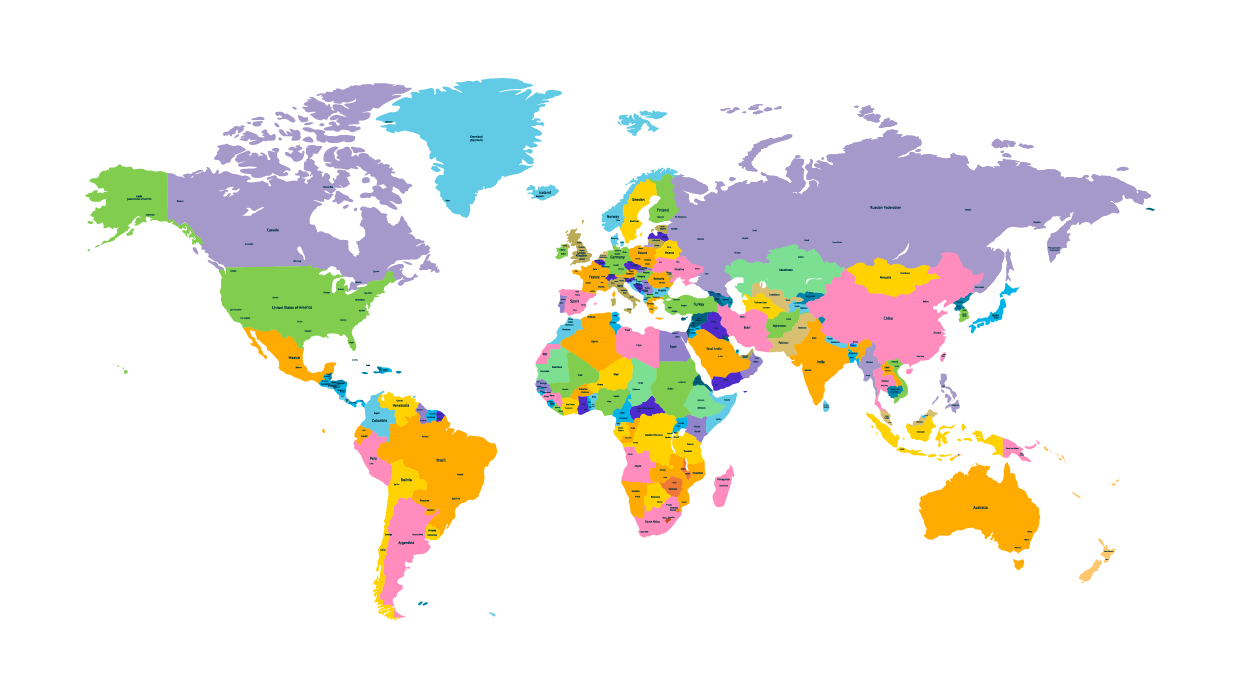

As a Forex trader, you can be located in any part of the world, but it is important to know in which time zone you are and how your local time corresponds to the local time of the major financial centers worldwide. The figure shows a world map where each color represents a time zone.

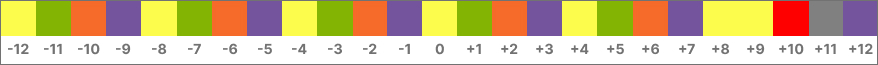

From west to east (left to right on the map), the time zones change relative to GMT as follows:

It is worth noting that in some countries, daylight saving time is practiced, so during different seasons, such countries will be in two adjacent time zones. The figure displays the time zones corresponding to standard time.

The activity on the Forex market is conventionally divided into four trading sessions: the Pacific session, Asian session, European session, and American session. Each session is active during the working hours of its respective region.

The Pacific session is the first to begin when the financial markets in Wellington, New Zealand, and Sydney, Australia, start their operations. It is closely followed by the Asian session, which sees the awakening of Tokyo (Japan), Hong Kong (Hong Kong), and Singapore (Singapore). The most active trading during these sessions involves the British pound sterling: GBP/JPY and GBP/CHF. Additionally, currency pairs involving the US dollar, such as USD/JPY, AUD/USD, and NZD/USD, are also traded as the opening of the Asian session coincides with the closing of the previous day's American session. The euro is relatively less traded until the European session opens in London.

The European session begins as the Pacific and Asian sessions come to a close. The major financial centers in Europe, such as London (United Kingdom), Frankfurt (Germany), and Zurich (Switzerland), come to life. London, being the largest financial center in the world, accounts for up to 30% of all trading in the international currency market. During the European session, currency pairs involving the British pound sterling (GBP) and the Euro (EUR) are actively traded. Conversely, the Japanese Yen (JPY) tends to lose its attractiveness throughout the trading day. Additionally, currency pairs involving the US dollar, such as USD/CHF, USD/CAD, and EUR/USD, are also traded during this session.

By the middle of the European session, the American session begins with the opening of major financial centers in New York (USA), which accounts for up to 15% of the global Forex trading volume. Most transactions take place during the overlapping period of the European and American sessions when liquidity in currency pairs such as USD/CHF, GBP/USD, USD/CAD, and EUR/USD is high. By the middle of the American session, when Los Angeles wakes up, the European session comes to a close, resulting in a decrease in market liquidity for European cross rates such as EUR/GBP and EUR/CHF. Experienced traders rarely trade these pairs during the American session.

Depending on the daylight saving time, the time in various financial centers around the world will differ from Greenwich Mean Time (GMT) by the number of hours shown in the following table.

| Finance center | Difference in hours from GMT time | |

| Winter | Summer | |

| Wellington | +11 | +12 |

| Sydney | +9 | +10 |

| Tokyo | +9 | +9 |

| Hong Kong | +8 | +8 |

| Singapore | +7 | +8 |

| Moscow | +3 | +4 |

| Frankfurt am Main | +1 | +2 |

| Zurich | +1 | +2 |

| London | 0 | +1 |

| New York | -5 | -4 |

| Los Angeles | -8 | -7 |

The table shows that not all countries observe daylight saving time as they remain in the same time zone during both winter and summer.

When trading on Forex, in addition to the activity of major financial centers during their respective trading sessions, it is important to consider that financial centers are closed on Saturdays, Sundays, and official holidays. The market activity and liquidity are generally low during these days. The market seems to be on hold, waiting for the next trading day. Even the market's reaction to significant events in the world is often delayed until Monday (the next business day). Therefore, experienced traders aim to close all open positions on Friday (more about opening and closing positions will be discussed later) to avoid unforeseen currency movements caused by events over the weekend.

On Mondays, Forex usually remains in a state of anticipation, and there is limited active trading. Participants are primarily trying to determine the dominant trends in currency exchange rates. However, active trading picks up from Tuesday and continues until the end of the Friday American session.